Canadian CFOs Believe Payroll, Accounting and Accounts Payable Will Benefit Most From AI

Artificial intelligence (AI) is expected to bring significant transformation to companies’ accounting and finance functions, new research suggests. The area predicted to benefit most is payroll, as predicted by 52 per cent of CFOs across Canada in a Robert Half Finance & Accounting survey. Accounting and accounts payable (38 per cent respectively) tied as second-most affected areas.

Increased reliance on technology has had a positive impact on accounting and finance employees, according to 80 per cent of Canadian senior financial managers polled for Robert Half’s Jobs and AI Anxiety report. Its influence is also expected to generate a substantial gain in the number of jobs worldwide: According to the World Economic Forum, intelligent technologies could create a net 58 million new positions by 2022.

CFOs were also asked, “What reasons do you think these functions will be most impacted by artificial intelligence in the next three years?” Their responses*:

CFOs were also asked, “What reasons do you think these functions will be most impacted by artificial intelligence in the next three years?” Their responses*:

Reduces costs 55%

Eliminates human error 53%

Reduces the burden on finance and accounting professionals so they can focus on higher value work 42%

Improves the bottom line 42%

Increases employee efficiency and output 41%

*Multiple responses permitted.

“Emerging technology should be seen as a valuable business and career resource by organizations and professionals alike,” said David King, senior district president of Robert Half Finance and Accounting. “Not only can it help minimize errors and boost efficiencies, it can also have a positive impact on individual job satisfaction and success. By automating routine tasks and enriching data analysis, employees are able to dedicate more time to strategic initiatives that can inspire insight into new areas of growth for the business.”

“AI’s growing role in the workplace is about improving jobs more than it is taking them away,” added King. “By keeping staff updated on company-wide IT adoption plans and providing the education and support to confidently navigate these changes, managers lay the foundation for a more creative, collaborative and capable workforce.”

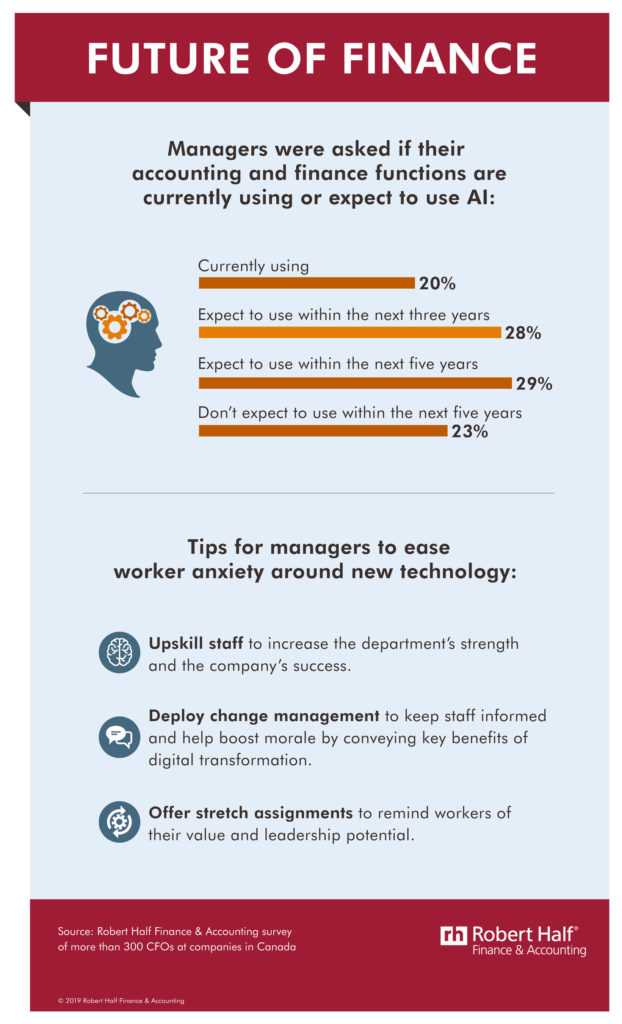

Robert Half Finance & Accounting offers the following tips for managers to ease worker anxiety around new technology:

Provide training. Take advantage of new technology by upskilling staff. Investing in professional development increases the department’s strength and the firm’s success.

Deploy change management. As companies adopt emerging technologies, managers need to communicate to staff what’s being done and what it means for their jobs. Keep morale up by conveying key benefits of digital transformation.

Offer stretch assignments. Remind workers of their value and leadership potential by engaging their talents in projects that encourage them to learn and build new skills.

The online survey was developed by Robert Half Finance & Accounting and conducted by an independent research firm. It is based on responses from more than 300 CFOs at Canadian companies with 20 or more employees. The survey developed for the Jobs and AI Anxiety report includes responses from more than 100 accounting and finance managers in Canada.

Founded in 1948, Robert Half Finance & Accounting, a division of Robert Half, is the world’s first and largest specialized financial recruitment service. The company has more than 300 locations worldwide.